Life is Filled with Opportunity Costs

Only here, opportunity just doesn't cost as much.

In addition to keeping costs low, {{{brandshortup}}} offers federal financial aid packages to fit your needs and budget. So you can pursue an affordable degree on your terms, focusing on your work, and your courses. We recommend beginning the process of establishing Federal Student Aid (FSA) funding at least 10 days prior to the month you intend to use FSA. Certain programs are not eligible for federal financial aid, visit our website for a complete list.

Studentaid.gov: Department of Education’s website where you can access your FAFSA, view your personal FSA information, learn more about loan repayment and other options, as well as complete a loan agreement, or Master Promissory Note (MPN) if you plan to receive loans.

myStudentAid app: myStudentAid is a secure mobile application supported by the Department of Education, which provides quick access to your FAFSA, student aid history, and other helpful information; available anywhere you download applications.

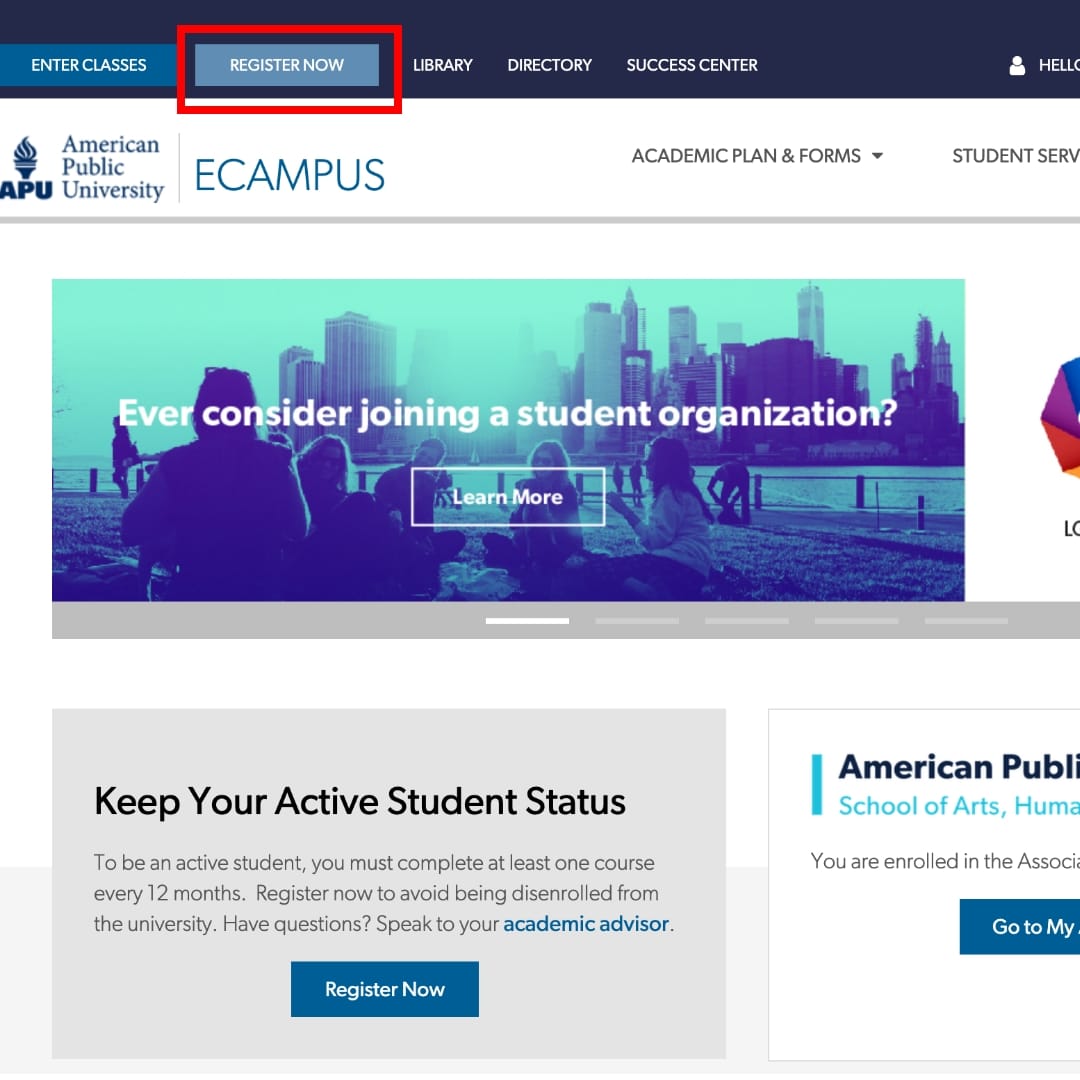

Financial Aid Advising Team: We are here to help! Please contact a Financial Aid Advisor via email [email protected] or call 855-731-9218; fax: 877-372-3292. Access the Finance Center in your ecampus for more resources and helpful information.

- Register for all courses you plan to take within your entire 16-week semester before your semester begins

- You must be enrolled at least half time per semester to be eligible for federal student loans

- Already registered? Contact Financial Aid Advising to discuss your eligible FSA start date

- Keep track of the steps listed and complete each action item provided

- Once submitted, the electronic file will enter into a 5-7 business day review

- Monitor email inbox for updates; additional documentation may be required after the initial review

- Master Promissory Note (MPN): If you plan to receive loans from the Department of Education, visit StudentAid.gov and sign your loan agreement (MPN)